IPT rates: could they rise again?

On the 1st October, 1994 - IPT (Insurance Premium Tax) was introduced at 2.5%. This was a standard rate applied to all insurance companies as the UK government believed they weren’t paying enough tax, because they weren’t subject to VAT.

IPT rate is very similar to VAT (Value Added Tax) which is added to everyday items across the country. IPT rates are added to the total of an insurance policy. These IPT rates have changed dramatically over the last 20 years since they where instated back in 1997.

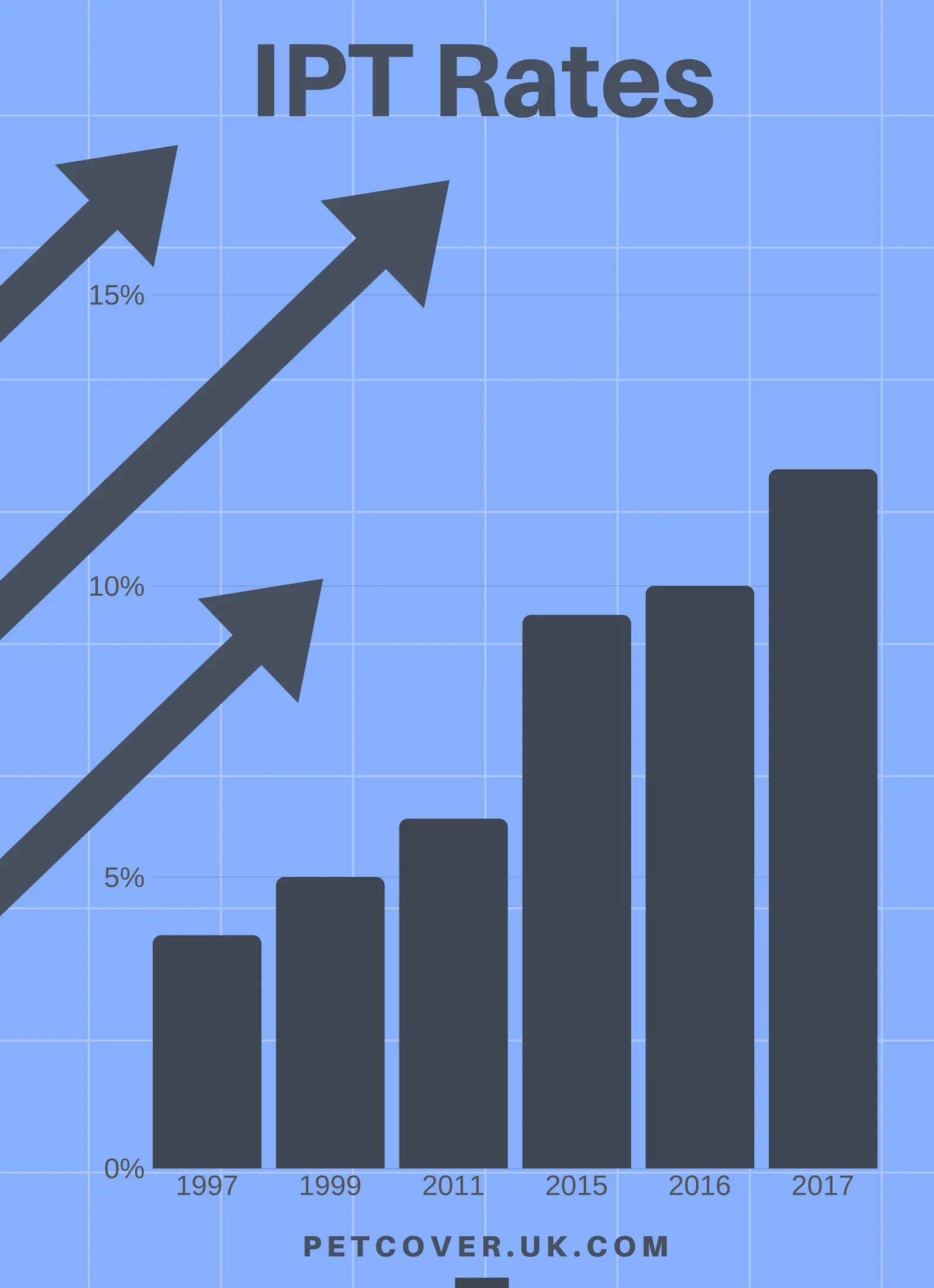

The current IPT rate history to date:

1 April, 1997 - rises to 4%

1 July, 1999 - rises to 5%

4 January, 2011 - rises to 6%

1 November, 2015 - rises to 9.5%

1 October, 2016 - rises to 10%

1 June, 2017 - rises to 12%

The changes in the 2015 budgets wanted to see an extra £8.1bn raised for the Treasury by 2021 , this meant the standard rate of the tax increase to 9.5%, the biggest jump in history. Chancellor George Osborne has justified such rises in recent years by saying that "Britain's insurance premium tax is well below tax rates in many other countries".

2018 saw no increase in the IPT rate however since 2015 the rate has increased every year, does this mean we are in for a mass rise in 2019?

Future articles to come will cover this rising tax rate.

The current IPT rate stands at 12%.

Share this article